Credit Card Calculator

What is a Credit Card?

A credit card is a plastic card that enables an individual to purchase goods, products or services by way of a credit line. Financial institutions, such as credit card companies or banks, will offer credit cards to those consumers who represent an ability, through their credit rating, to meet the terms of the credit card contract.

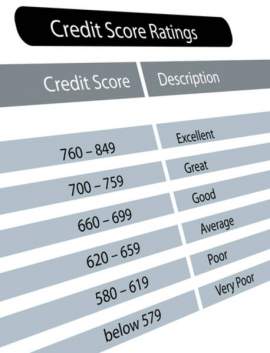

It is crucial to understand the varying interest rates or APR’s attached to each credit card. Generally, those individuals with lower credit ratings, if approved, will receive a credit card with unfavorable terms and high interest rates.

A credit card’s rates are applied to the individual’s balance at the end of each billing cycle. For example, if an individual is given a credit card with $500 worth of credit and an APR of 20%, and the individual spends throughout the month or length of the cycle the full amount of available credit, he or she is required to pay the lending institution the full $500.

If the individual does not pay the $500 and only pays the minimum (typically $15) the APR of 20% will be applied to the next month’s bill in the form of a monthly fee (.20/12), or .01667. Add 1 to this figure to reveal 1.016, which is then multiplied by your remaining balance. Therefore, if you have $485 due next month, you will take $485 and multiply it by 1.016 to yield a new balance of $492.76. The terms attached to each credit card will vary based on the issuing institution’s protocol and the credit score of the prospective borrower.

What is the Annual Percentage Rate?

The annual percentage rate attached to a credit card describes the rate for a whole year. The APR is annualized, rather than the monthly fee or rate applied to other forms of credit such as mortgage loan. In essence, the annual percentage rate is the numerical percentage figure used to represent the cost of credit.

The APR is the yearly amount a consumer must pay for acquiring a loan or other form of credit. Since the majority of credit card bills are paid each month the APR must be divided by 12 to reveal the monthly percentage rate that will be attached to any unfulfilled credit.

If your APR is 18%, it will be used as a decimal, so it will effectively take the form of .18. To calculate your APR and the affect it will have on your monthly statement, you take the .18 and divide by 12 to yield a .015 figure. Add 1 to this Figure and you will have 1.015. This number is then multiplied to the amount of credit owed.

What is a Credit Card Calculator?

A credit card calculator is a resource offered by many banking websites and financial institutions that enables a holder to determine their payment amount required to satisfy the credit card balance. The credit card calculator uses the annual percentage rate or interest and the number of months you expect to pay the balance, plus interest.

The basic credit card calculator has three units for entry: the credit card balance, the number of months the individual wants to pay off the balance, and his or her annual percentage rate. Before entering the figures into the credit card calculator you must understand that your APR should be divided by 12 to reveal the monthly interest rate that will be attached to your unpaid credit line.

So for instance, if you have a credit limit of 1,000 at a 20% APR, subsequently owe $800 this billing cycle and only pay $600, your remaining credit owed is $200. This amount will be carried over to the next month times the 20% APR divided by 12 months (.2/12) which is .01667 plus 1 equals, 1.016% interest per month. Therefore, your carried over balance would be $203.33 (200X1.016).

The primary benefit of the credit card calculator is that a borrower does not have to do the math by hand. To figure out their APR and their expected pay-off balance, as well as their monthly payment amounts, an individual using a credit card calculator is only required to input the coordinating totals.

Credit Card Calculator for Repayment Amounts

For a repayment amount, the individual using a credit card calculator will submit their credit card balance (for this sake we will use $1,000), which represents the amount owed in the upcoming billing cycle. Following this entry the individual will input their APR (15% for this example) and the desired number of months until debt free (8 for this example).

When this information is inputted into the credit card calculator the individual will see the following results: “It will take you $132.13 every month to pay off your credit card.” The credit card calculator in this example takes your balance, the attached interest and the desired number of months to calculate the monthly payments needed to pay off your credit card.

NEXT: What You Must Know When Conducting a Credit Card Comparison