Ways for Credit Card Debt Relief

What is

Credit Card Debt?

Credit card debt occurs when an individual’s debt,

as a result of their credit card use, exceeds their ability to pay the debt. In

essence, the debt is beyond the borrower’s disposable income and savings. This

unfortunate situation leaves them vulnerable to increased fees, added interest

and other terms associated with credit card debt.

As a result of these terms,

credit card debt possesses an insidious characteristic. At first the debt may

seem manageable, but overtime as spending remains the same and the interest is

piled on, the debt mounts to a suffocating level.

Credit card debt is fairly easy to get

involved with, even if the consumer maintains some sort of budget. The

reasoning behind this prevalence is that financial institutions which issue

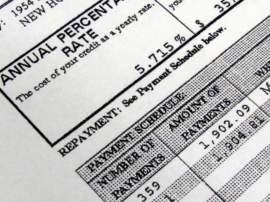

credit cards do so with interest or APR rates attached. These rates are

multiplied into unpaid monthly balances. Over time these small percentage

increases can suffocate a borrower.

Example of how Credit Card debt can amass

If a consumer has a credit card with an available

credit line of $500 and an annual percent rate of 20% and spends the full

credit amount of $500 in one month on various goods and services, he or she

will be required to pay off that debt over time. Credit card billing cycles are

monthly, meaning the individual is required to pay off all or some of the debt

at the end of each month.

If the individual does not pay the $500 and only pays

the minimum (typically $15) the APR of 20% will be applied to the next month’s

bill in the form of a monthly fee (.20/12), or .01667. Add 1 to this figure to

reveal 1.016, which is then multiplied by your remaining balance. Therefore, if

you have $485 due next month, you will take $485 and multiply it by 1.016 to

yield a new balance of $492.76. This added $7.76 may not seem like much, but

over time as more credit is made available and subsequently used, this figure will

grow exponentially.

Credit Card Debt Relief

There are numerous ways an individual can mitigate

their debts. It is crucial to seek credit card debt relief because credit

scores are largely based on an individual’s debt to credit ratio. Therefore, an

individual with a high outstanding balance will possess a lower credit score.

A

diminished score will impede a borrower from obtaining a suitable credit card,

and in grave cases, will impede an individual from obtaining sources of

financing, such as personal loans, mortgages, leases and even employment.

One of the basic forms of credit card debt relief

is achieved through consolidation. Consolidating loans or outstanding balances

enable a borrower to group their debts into one pool, thus allowing them to

make fixed payments against their amount owed. Debt consolidation is often

initiated by the lender. A borrower may contact the lender to effectively crate

a repayment plan.

Another means to initiate credit card debt relief

is to seek assistance by a third party, such as a credit counseling

organization. These groups will educate individuals in regards to how to seek

credit card relief and will also work with lenders to restructure the

borrower’s debt obligations.

The last form of credit card debt relief is filing

for bankruptcy. This form of credit card debt relief may not be desirable, but

it will effectively erase the individual’s debts over time.

NEXT: Why Would I Need Credit Counseling