Quick Guide to Balance Transfer Credit Cards

What are

Balance Transfer Credit Cards?

Balance Transfer Credit Cards allow individuals in

possession of them to undertake what is known as a ‘balance transfer’ with

regard to a preexisting, outstanding credit card balance. A balance transfer

involves the movement of a balance incurred on one credit card onto a new

credit card.

Through the

undertaking of a balance transfer, the balance – ranging from a portion to the

entirety of the preexisting balance – will be transferred to the new credit

card. However, while Balance Transfer Credit Cards prove to be valuable and

economical instruments for certain individuals, associated rates, interest, and

charges should be investigated prior to engaging in balance transfers.

Standards and Practices of Credit Terms Specific

to Balance Transfer Credit Cards

In most cases, the following standards and

practices are specific to Balance Transfer Credit Cards:

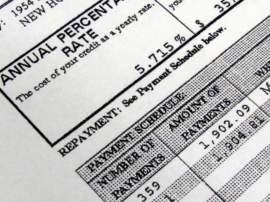

Many Balance Transfer Credit Cards allow for a ‘0%

Annual Percentage Rate (APR)’ upon the approval for the receipt of these types

of credit cards. However, the absence of an interest rate exists on a temporary

basis. Periods of 0% APR will range from 6 months to a year.

Balance Transfer Credit Cards allow for these

‘grace periods’ in order to allow the individual a finite period of time to

enact repayment without the threat of additional interest. However, subsequent

to the termination of the grace period, applicable interest and APR are enacted.

Although Balance Transfer Credit Cards may offer

the absence of interest for a finite period of time, prompt, scheduled payments

are required within the grace period. In the event that a payment is late or

not furnished, many credit institutions will terminate the grace period. This

results in the reinstatement of applicable interest rates.

Balance Transfer Credit Cards: Profile and

Background

The following details are inherent within the

financial structure and legal ideology of Balance Transfer Credit Cards:

Balance Transfer Credit Card Credit APR and

Spending Limits

The credit limit typically applicable to Balance

Transfer Credit Cards may vary in accordance to the predetermined amounts

offered by the credit institution upon approval. Credit limits and histories

are typically directly proportional with the interest offered. Individuals with

higher credit scores are more apt to receive lower interest rates and higher

credit limits.

Balance Transfer Credit Cards Legality

Balance Transfer Credit Cards will typically fall

under the jurisdictions of both Finance Law and Commercial Law.

Finance Law is the legal specialty regulating and

overseeing legislation applicable to the exchange and the circulation of

monies. This takes place in both transfer activity undertaken involving hard

currency, as well as Balance Transfer Credit Cards.

Commercial Law is the legal field that enacts the

regulatory oversight of standards and practices occurring within the commercial

marketplace.

Contingency Plans in the Event a Rejected Balance

Transfer Credit Cards Application

In the event that your application for the receipt

of a Balance Transfer Credit Cards has been rejected, additional options may

exist for your consideration. You are encouraged to investigate the following

options, which may provide assistance with regard to both the receipt of a

credit card in addition to measures undertaken in order to improve your

respective credit score.

Individuals interested in applying for credit cards are encouraged to contact legal and financial professionals in order to better understand both the risks and ramifications implicit within any nature of credit cards.

NEXT: Revealed Here: How to Get the Best Credit Card Deals