4 Things You Must Know Before You Apply for a Credit Card

Before You

Apply for a Credit Card

Understand that Credit Card Companies and

Institutions are a Business

Credit cards are financial instruments that

allow consumers the opportunity to utilize

pre-approved funds in the form of financial loans. Akin to the process of

traditional loans, funds spent with regard to individual credit limits are

required to be repaid promptly in a predetermined and scheduled fashion.

However, fees associated with late payments and varying interest rates incurred

as a result of failed repayment account for profit rendered by credit card

companies.

Many individuals who undertake the facilitation of credit card-based spending do not perceive the spending to be analogous with ‘tangible’ monies due to the fact that there does not exist a physical monetary exchange. As a result, the prospect for reckless and irresponsible spending is not uncommon. Before you apply for a Credit Card, you are encouraged to review the entirety of the terms and conditions expressed within a respective credit card contract.

Understand the Standard and Practices Implicit

within the Financial Terms and Conditions

Within a credit card contract, there is a laundry-list of terms and conditions concerning the usage of the underlying credit card. Responsible navigation with regard to credit cards will allow for

individuals to not only build their respective credit scores, but also be

spared additional surcharges incurred as a result of failed repayment. Irresponsible

and uninformed usage of credit cards retains the potential for financial

devastation.

The following components are amongst the most primary to be analyzed when you apply for a credit card:

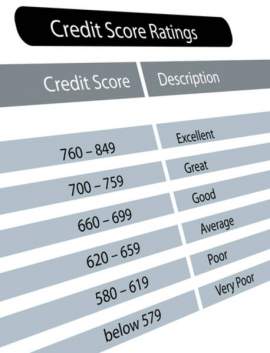

Credit Score

A credit score is a rating determined on an individual basis. Reported by credit agencies via a number, the credit score reflects a consumer's trustworthiness with regards to his/her ability to fulfill loan or credit obligations. A high credit score reflects a consumer's ability to meet credit card (and other loan payments) on time and in full (or close to in full). Higher credit scores enable borrowers to secure financing with favorable terms and higher limits. In turn, a consumer with a lower credit score will be rejected from receiving credit or will be given credit cards (and other loans) with unfavorable rates and limits.

Credit History

Your credit score is a profile illustrating past

repayment history, outstanding loans, spending behavior with regard to a credit

card, as well as the analysis of past credit limits. A credit limit is the

finite amount of funds available for use with regard to an individual credit

card.

Become Familiar with Interest and Annual

Percentage Rates (APR)

Interest is an expressed and

established percentage of the balance of a credit card. Interest is added to the unpaid balance and is required to be paid in full. APR, which is the rate

at which additional fees of ownership are accrued in conjunction with a credit

card’s outstanding balance, is determined on a monthly basis. If a consumer pays his/her credit card in full every month, they will not subjected to interest rates.

In the event that you wish to apply for a credit

card, the analysis of applicable interest rates and APR is imperative in order

to determine if the expected payments will be possible. This will assist in

avoiding defaulted repayments and surcharges.

Research Applicable Credit Card Laws and

Legislation

The

Credit Card Accountability, Responsibility, and Disclosure Act, impedes credit card companies or financial institutions from practicing predatory lending and exploitative measures. That being said, consumers are encouraged to contact financial and legal professionals to familiarize themselves concerning the risks

and ramifications associated with credit cards.

NEXT: Legal vs. Illegal Credit Card Offers