The Importance of Credit Scores

What is a Credit Score?

A credit rating is a statistical analysis of an individual’s credit history. The credit score is delivered as a number based on the individuals debt vs. credit amount. This number is used by numerous lenders (organizations that distribute loans or credit card companies) to determine whether or not they will award an individual or business with a line of credit. In essence, the credit score is the fundamental statistic used to evaluate an individual or entity’s credit worthiness.

There are three agencies that will issue a credit rating: TransUnion, Experian and Equifax. The majority of lenders will evaluate the credit score of two of the three agencies; the credit score is distributed in a report, which will detail the prospective borrower’s credit history.

The formula used to determine a credit score is known as FICO. Named after the Fair Isaac Credit Organization (the first company to use credit ratings), this formula will yield a number ranging from 300 to 900. The lower the credit score, the greater the risk of default; an individual with a score that is below 500 is viewed as a risky borrower to most lenders.

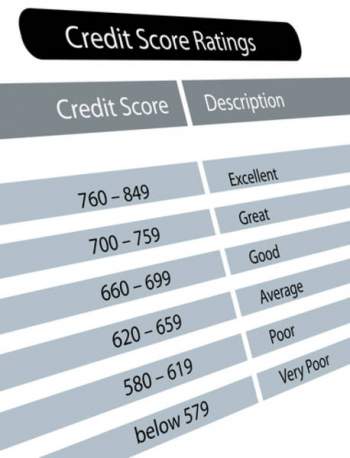

The risk in this sense is tied into the borrower’s ability to repay the loan or pay-off his or her credit card. The credit score, thus acts as a gauge to determine a risk of default; ratings closer to 300 are viewed as extremely risky, while those above 800 are viewed as possessing limited to no risk.

The FICO Calculation:

The FICO score is calculated based on the percentage of an individual’s total credit that is currently being utilized, the amount of time an individual has had an open line of credit, the types of credit lines the individual possesses, the amount of past lines of credit the individual has had, and the number of delinquent payments.

Each of these variables contains the following percentage weight to determine one’s credit score: Amount of credit currently utilized (30%), the period of time the lines of credit have been open (15%), the types of credit lines open (10%), the size of past lines of credit (10%) and the number of delinquent payments (35%).

In a general sense, a credit score around 500 is viewed as high risk; this score will generally yield a refusal to lend. If an individual obtains a credit line with a credit score around 500, they will be given a line of credit with high interest rates, exorbitant fees and complicated terms.

A credit score of 800 or above, in contrast, will grant an individual the lowest possible interest rates, small down payments (where applicable) and limited fees. A credit score of around 650 is viewed as safe enough to receive favorable terms; this score will typically be good enough to receive a new line of credit.

How do I view my Credit Score?

The majority of organization offer online access to your credit score. These websites will offer reports from the leading credit agencies and detail why your score may be low. Given the importance of favorable terms and interest rates it is recommended that you view your credit score to ensure that no mistakes have been made.

Often times an individual’s credit score will be lowered because of a forgotten debt or miscalculated payment. In order to raise one’s credit score, they must realize the position they are in. As a result of this, paying a small fee to view your credit score is well worth it.

NEXT: 4 Questions Answered about the Best Credit Card Offers