All About The New Credit Card Laws

Why were new Credit Card Laws implemented?

To ease the effects of the recession and more specifically the credit crunch, President Barack Obama has signed a plethora of new credit card laws that aim to ease the financial burdens experienced by American consumers. These new credit card laws are federal laws, meaning they must be adhered to by all issuing credit card companies, financial institutions engaged in issuing credit cards and various lending institutions in the United States.

The new credit card laws instituted by President Obama aim protect the millions of American consumers who rely on credit cards. These new credit card laws will aid in effecting one’s budget and will restrict the issuing organizations in regards to how much interest they can charge as well as limit the amount of usage fees and finance charges found in a credit card application.

The basics of New Credit Card Laws:

President Obama’s new credit card laws will make credit cards more transparent; the terms and fees attached to credit cards, under these new laws, will be easier to understand for everyday consumers. Credit card companies are now required to offer their holders an advanced notice of changes in their credit card terms. Including in these terms are fewer penalty fees, interest payments and late charges.

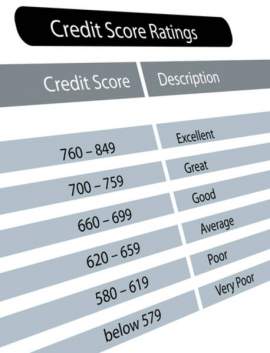

To prevent the over-extension of credit—one of the predominant factors that precipitated the economic collapse—new credit card laws will make the ability to obtain credit cards more difficult. Prior to 2008, credit card companies would issue credit cards and sources of financing with little regard to the individual’s credit history or rating.

Those individuals with low credit scores or a lack of credit history would be given a credit card with a high interest rate or APR—issuers would give these cards with a low credit amount as a way to profit off risky borrowers. In addition, debts were commonly packaged and sold as CDO’s—a profitable economic mechanism that eventually failed and fueled the recession.

As a result of the mass defaults, the issuance of credit cards will be placed under a more stringent scope; those individuals with low credit scores or low-income families will typically be unable to access a line of credit.

New credit card laws will also allow the holder to pay-off their bills immediately. These no credit card laws essentially do away with the month-long grace period that was typically attached to a holder’s credit card bill.

New Credit Card Laws and Changes to interest Rates:

New credit card laws will do away with retroactive interest rate increases on existing balances. Furthermore, new credit card laws will only allow for interest rate hikes on existing balances under limited conditions, such as when a promotional interest rate ends, the cardholder makes a late payment, or if there is a variable rate of interest attached to the credit card.

Interest rates on new transactions, under the new credit card laws, may only increase after the first year of the agreement. Significant changes in the terms and conditions of the credit card cannot occur without 45 days of advanced notice. And lastly, in regards to universal default, the practice of raising interest rates on holders, based on their payment records with other unrelated credit issuers is no longer permitted under the new credit card laws.

NEXT: Easy Steps for Credit Card Protection