Revealed Here: How to Get the Best Credit Card Deals

What are

Credit Card Deals?

Individual Credit Card Deals are examples of the

terms, conditions, standards, and practices associated with individual credit

card contracts. Within such expressed contracts, the most attractive Credit

Card Deals are considered to permit the following allowances and opportunities

to an individual in possession of a respective credit card:

Annual Percentage Rate (APR): Credit Card Deals

allowing for the lowest interest rates, as well as the lowest monthly

surcharges accrued through the calculation of percentage rates in conjunction

to outstanding balances are considered to be the most attractive.

Credit Limit: Credit Card Deals allowing the

maximum amount of funding allotted to an individual owner of a credit card, determined

upon the analysis of both credit history and credit score belonging to an

individual, are considered to be the most attractive.

Getting the Best Credit Card Deals

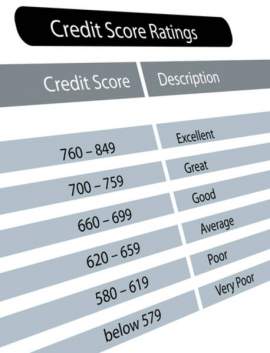

While individuals with credit scores and ratings

considered to be ’excellent’ or ‘good’ may not experience difficulty attaining

the most attractive Credit Card Deals, the prospect for the attainment of such

Credit Card Deals may prove to be more difficult for individuals with credit

scores not considered to be exemplary. However, in most cases, and with some

effort put forth, any individual retains the ability to be allowed the

opportunity to receive Credit Card Deals.

Repayment

In order to improve individual credit scores, the

prompt repayment, responsible usage, and the compliance with terms of service

will typically result in increased credit limits and raised credit scores. Due

to the fact that a higher APR is not considered as being a component of credit

card deals, the prompt repayment in accordance to the schedule expressed by the

credit card company will serve to increase individual credit scores.

Upon satisfying a full repayment on a monthly

basis, that individual allows themselves to be relieved of additional

surcharges incurred as a result of interest and APR. Furthermore, the prompt

and diligent adherence to repayment schedules allows for individuals to not

only raise their respective credit scores, but also increase their respective

credit limits and allow them to be eligible for credit card deals.

A functional example of this process may involve

an individual considered to retain a ‘low’ or ‘poor’ credit score, which

allowed them to receive a credit card with 20% APR. In the event that the

individual has spent $100 for that month, the full repayment of the $100

balance will relieve that individual of the additional $20 incurred as a result

of the APR.

Credits Limits and Spending Behavior

A credit limit is defined as the maximum amount of

funding allotted to an individual owner of a credit card. The determination of

a credit limit relies heavily on both the credit history and credit score

belonging to an individual. Individuals considered to retain the most exemplary

credit scores are typically the primary candidates of eligibility for credit

card deals.

In order to increase credit ratings and credit

limits, individuals are encouraged to avoid exceeding the respective credit

limit offered by the respective credit card. This is commonly referred to as

the ‘Maxing Out’ of a credit card. In addition, individuals are encouraged not

to surpass the 50% mark with regard to their individual balance remaining.

An example of this is in the event that an

individual is allowed a $1,000 credit limit, they are never encouraged to spend

an excess of $500 in the event of measures undertaken in order to repair credit

scores.

NEXT: The Secret Behind Credit Card Companies