Credit Reporting Agencies

What are Credit Reporting Agencies?

Credit reporting agencies are companies that collect information about a person’s ability to handle credit. They can then sell that information to certain other businesses that can use the information to evaluate applications for insurance, employment, credit, or other allowed purposes.

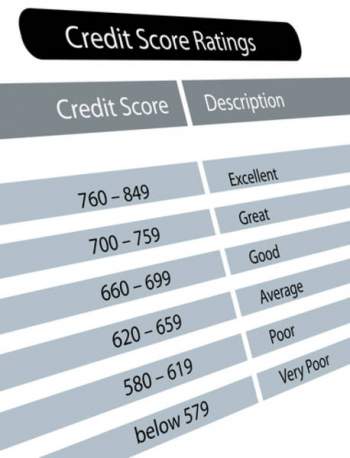

These credit reporting agencies have sounds agreements with government agencies that allow them to receive and combine credit information from creditors who optionally provide the information. This combined information is then sold, sometimes by smaller reporting agencies to the consumer. This is most often done in the form of a credit report, which helps determine through a credit score the creditworthiness of an individual. A credit reporting agency issues credit reports that describe just how an individual manages any debts they may have and how they manage them. It can also discuss payments made and how much available credit they have they is not used and whether the individual has applied for loans.

Credit reporting agencies can collect information about:

• Public record information (for example, bankruptcy or judgments)

• Inquiries about credit record as well as names and companies who have inquired

• Information on credit accounts, such as date opened, balance, account status, payment patterns, most recently activity of the account.

Credit reporting agencies do not collection information about:

• Personal background or lifestyle

• Racial or religious information

• Medical history

• Political preference

• Criminal record

There are three major credit reporting agencies in the U.S.:

• Experian

• Equifax Credit

• TransUnion

Under the Fair Credit Reporting Act, a federal act passed in 1970, a new amendment from 2003 states that all consumers can order a free copy of their credit report from each of these credit reporting agencies once a year. These credit reports can be ordered by mail, through the phone, or online. While it is possible to order all three credit reports from each credit reporting agency at once, it is also possible to order them separately.

By federal law, credit reporting agencies can only report information for a certain amount of years. For example, bankruptcies can be reported by credit reporting agencies for up to 10 years while other negative information can be reported for up to 7 years. However, negative information can be considered indefinitely when applying to a job paying more than $75,000, a life insurance policy worth at least $150,000, or any lines of credit for at least $150,000.

An individual can also request more information be reported by credit reporting agencies. For example, creditors sometimes do not file information to credit reporting agencies. This can be changed by asking the agency to add the information.Furthermore, if there are any errors in the credit report, an individual can report the problem to the credit reporting agencies. They will then have to investigate the error and give a response to the individual within 30 days.