A Guide to Instant Approval Credit Cards

What is an

Instant Approval Credit Card?

The term ‘Instant Approval Credit Cards’ is

applicable both to the nature of the credit card, as well as the nature of the

credit card offer. In both cases, Instant Approval Credit Cards represent

credit cards in which the approval process with regard to obtaining a new

credit card is instantaneous. Instant Approval Credit Cards exist within a

variety of circumstances, ranging from offers received through the mail, as

well as instant approval upon application both over the phone and over the

Internet.

Standards and Practices of Credit Terms Specific to

Instant Approval Credit Cards

In most cases, the following standards and

practices are specific to Instant Approval Credit Cards:

For individuals with credit scores considered to

be ‘good’ or ‘excellent’, the receipt of Instant Approval Credit Cards can be

considerably easy. In many cases, credit scores that are perceived to be

exemplary will result in instant approval.

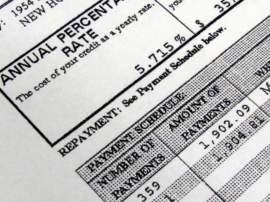

Although Instant Approval Credit Cards may be

considered to be both convenient and easy, individuals undertaking the

application process with regard to Instant Approval Credit Cards are encouraged

to be wary. In many cases, Instant Approval Credit Cards retain considerably

high Annual Percentage Rates (APR), which require the full monthly payment of

the outstanding balance in order to avoid interest surcharges.

Instant Approval Credit Cards: Profile and

Background

The following details are inherent within the

financial structure and legal ideology of Instant Approval Credit Cards:

Instant Approval Credit Cards may be accessed both

in a physical setting, as well within a virtual one. Furthermore, the denial of

applications for Instant Approval Credit Cards taking place over the Internet

may not be applicable to telephone or physical applications. Many individuals

have reported approval over the telephone subsequent to a rejection taking

place online.

Instant Approval Credit Cards are not only

available throughout the week, but also on the weekends. As a result, those in

a financial bind may choose to undertake the application for Instant Approval

Credit Cards.

Instant Approval Credit Cards: Legality

Instant Approval Credit Cards will typically fall

under the jurisdictions of both Finance Law and Commercial Law.

Finance Law is the legal specialty regulating and

overseeing legislation applicable to the exchange and the circulation of monies.

This takes place in both transfer activity undertaken involving hard currency,

as well as Instant Approval Credit Cards.

Commercial Law is the legal field that enacts the

regulatory oversight of standards and practices occurring within the commercial

marketplace. With regard to Instant Approval Credit Cards, statutory legislation

is undertaken within the precepts of Commercial Law to ensure that any nature

of predatory lending or financial exploitation is an illegal offense.

Instant Approval Credit Cards Assistance

Although predatory lending was determined to be a

criminal offense as a result of the CARD Act of 2009 (The Credit Card

Accountability, Responsibility, and Disclosure Act), certain institutions

offering Instant Approval Credit Cards may grant the approval for candidates

whom they suspect will be unable to satisfy repayment, thus subjecting that

individual to higher APR in conjunction with interest fees. Individuals

interested in the receipt of Instant Approval Credit Cards are encouraged to

engage in both accredited legal and financial counseling with trained

professionals prior to any financial commitment.

NEXT: A Guide to Interest Free Credit Cards